Although the thought of spending millions of dollars on non-existent property may seem implausible, investors are becoming committed to making large bets on virtual land, spurred on by feverish forecasts of future growth in this space. Hence, what was once just a fad has acquired such traction that even conventional investors and traditional real estate companies are now getting into the game. Virtual real estate is the ultimate mixture of our real-world utilities with the blockchain world.

2021 – The Crucial Year for Virtual Real Estate

Throughout 2021, we have all witnessed a virtual land boom in the metaverse. After Facebook rebranded to META and declared a strong interest in the metaverse in the last quarter of 2021, there has been an unprecedented surge in the sale of metaverse real estate. The fact is that both corporate and individual investors are racing to get a piece of virtual real estate while it is still accessible.

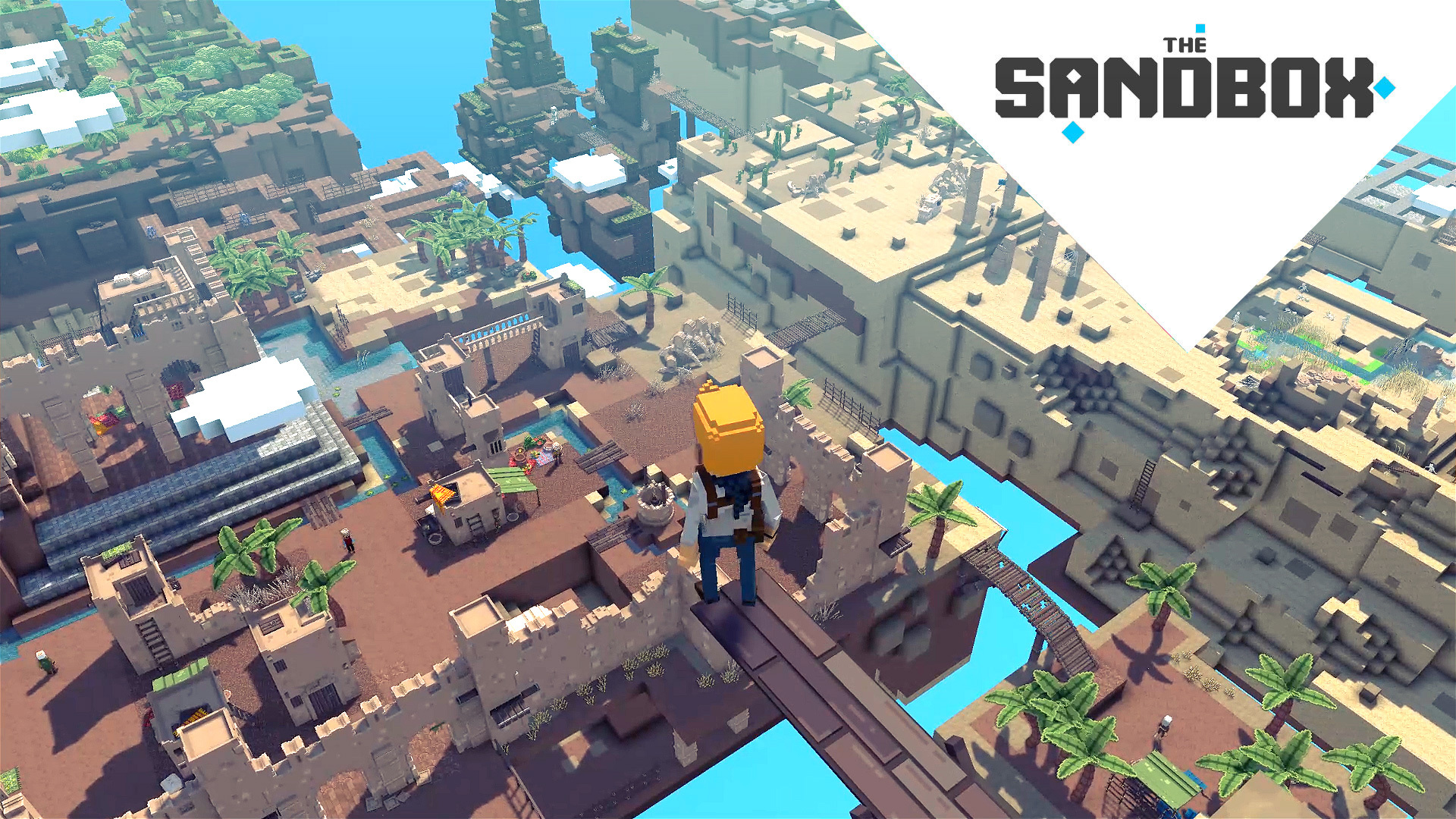

Overall, virtual land sales have hit a record high of $500 million in 2021, and are expected to reach over $1 billion in 2022. Prices in the virtual real estate sector increased at an astronomical rate - Republic Realm said in June 2021 that it had bought a 16-acre plot for close to $1 million ($913,228.20 to be precise). Only 5 months later, prices for virtual land reached a new high point in November 2021, with one corporation purchasing property in the Sandbox metaverse for a record $4.3 million.

If someone would like to get an idea of the future development that might come, well, the value of metaverse real estate is expected to expand at a CAGR of 31.2 % from 2022 to 2028, as investors' interest continues to grow.

Why Should Anybody Invest in Virtual Real Estate?

Metaverse real estate provides users with a virtual substitute of a physical location where they can interact with other people online. Individuals may utilize their digital land to interact, work and play games with their friends from around the world. Creators may monetize the content of their intellectual property by charging for access or exchanging their NFTs (non fungible tokens) for virtual or fiat currency.

Moving forward, the utilization of virtual properties by brands may be used to market services, arrange virtual product launches, host events and deliver unique customer experiences. These pieces of digital property represent a profitable investment opportunity for real estate investors. Digital world properties may be built, flipped, or leased in the virtual worlds, just as they can in the real world. Indeed, there are a plethora of potential applications for metaverse real estate.

Investors buy virtual lands in Sandbox and other virtual worlds, spending record amounts of money.

Sandbox, Decentraland, Cryptovoxels, and Somnium are some of the most prominent real-estate players in the world of digital property. Each is suited to a certain goal and operates in a specific manner, but their common objectives are convergent: to construct a network of 3D digital worlds that facilitate borderless social relationships.

Comprehending the Appeal of the metaverse

In the end, the blockchain architecture that underpins asset ownership in the metaverse is responsible for its disruptive potential. Blockchain provides the real estate sector with a competitive advantage by attaching non fungible tokens to real estate transactions. These, by virtue of being part of a blockchain, offer immutable proof of ownership and can also provide a number of financial asset capabilities typical of real estate investments, such as serving as loan leverage.

Even setting aside their importance in the metaverse, NFTs are a valuable asset class in their own right. Through NFTs, digital real estate might be traded, rented and developed. NFTs and virtual reality (VR) work together to enable customers to invest in digital land that they can not only possess but also see in 3D (whether through a virtual reality headset or a normal screen) and interact with other users inhabiting virtual lands, without the property being technically "real."

Exploring the characteristics of virtual real estate

Many of the features of real-world real estate are present in the virtual world of real estate, such as uniqueness, scarcity, and immobility. After all, there are only a limited amount of properties available in any location in the metaverse, each of which is absolutely unique.

Virtual property has a breakthrough potential for the real estate industry, with far-reaching and long-term consequences. When it comes to property ownership and investing, it seems like a logical progression to take it to the decentralized digital realm,

Given these features, a rise in demand will simply do what any free-market economy does: it will raise prices.

Real estate development in virtual worlds is a new frontier for property investing companies.

Buying, investing, developing virtual land

Currently, just over 25,000 individual cryptocurrency wallets are used to invest in metaverse real estate and other assets. One of the headline-grabbing transactions last year was a Sandbox user buying a plot of virtual land next to Snoop Dogg's residence for an eye-watering $450,000 (71,000 SAND, Sandbox's official currency). Just the sales of digital plots of land neighboring Snoop Dogg on that platform have totalled $1.23 million by December 2021. The future growth of real estate market in virtual lands seems inevitable.

It should be emphasized that companies investing millions of dollars in digital real estate are not just private investors or investment funds. In the future, the metaverse world of land holdings will see a growing number of high value properties that started out as bare digital plots that were developed into luxury hotels in busy virtual streets, metaverse offices, casinos, virtual stadiums and concert venues hosting events grossing millions of dollars. Even if the virtual land boom ends, the investors who are developing real estate in metaverse platforms like Sandbox, Decentraland, Fortnite or Roblox, might see significant profit, in the form of money or business opportunities.

Bottom Line

At first glance, the concept of owning virtual land might seem farfetched. However, we should remember that many previously have questioned the potential importance of the internet, and subsequently social media, even though it seems absolutely ludicrous to us inretrospect. The metaverse, according to experts, will grow into a fully operational economy over the next few years, giving us a synchronous digital experience that is as integrated into our daily lives as email and social networking are today.